VAT in the UAE is a type of general consumption tax which is collected incrementally based on the value added at each stage of production or sales. VAT is an indirect tax also known as the consumer tax. It is charged at each stage of the supply chain where the end users have to ultimately pay the tax. VAT is imposed on most supplies of goods and services that are bought and sold or consumed.

All you need to know about VAT

What is Value Added Tax (VAT) & how does it work?

In the UAE, VAT is all set to be executed from 07:00AM on 1st January 2018. The GCC (Gulf Co-operation Council) countries have agreed ‘in principle’ to the GCC VAT Agreement to apply VAT in the region at a standard rate of five percent. In the GCC, the Saudi Arabia and the UAE will be the first two countries to launch VAT from January 1, while other GCC countries will follow the same in the coming years.VAT shall be applicable on almost all the daily basic consumable goods and services that the inhabitants consume on a daily basis. VAT is one of the most common type of indirect tax which has been adopted by more than 150 countries around the world.

VAT is categorized as

1. Standard Rate: Standard Rate is a supply on which tax is charged at 5% and for which the related input tax is deductible. All supplies other than the goods/services which are not mentioned below in Exempted & Zero Rated are Taxable at a Standard Rate.

2. Exempted:: An exempt supply is a supply on which tax is not charged and for which the related input tax is not deductible.

What sectors will be Exempted?

1.Local passenger transport

2.Bare land

3.Certain financial services

4.Supply of Residential buildings

3. Zero Rated: A zero-rated supply is a taxable supply on which tax is charged at 0% and for which the related input tax is deductible.

What sectors will be Zero Rated?

1.Exports

2.International Transport of passengers and goods

3.Investment in gold, silver, and platinum

4.Residential Buildings (First sale or lease within 3 years)

5.Certain Education Services

6.Healthcare Services

7.Medicines & Medical Equipment

8.Crude Oil & Natural Gas

Certain key measures to be ensured by the management of the company when doing business under VAT in UAE. Important amongst them are –

1.Proper documentation and maintenance of records

2.System readiness

3.Tax points

4.Timely filing of VAT return and payments

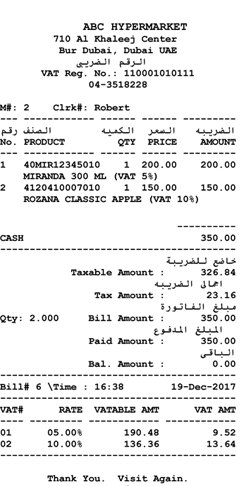

POS with VAT

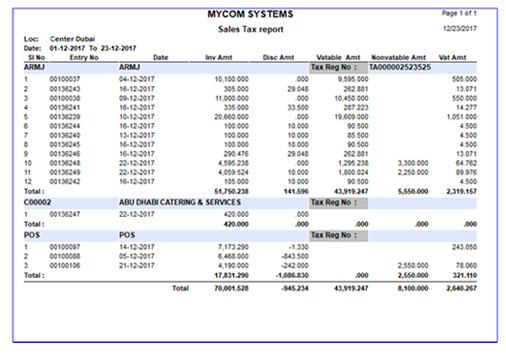

Sales Tax Report

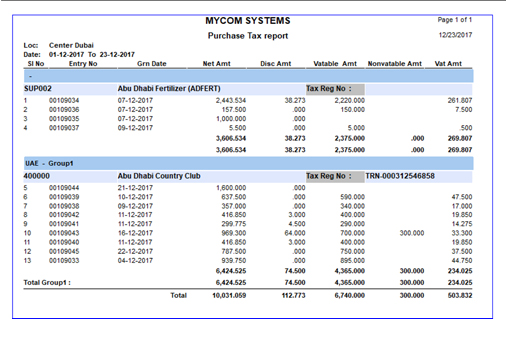

Purchase Tax Report

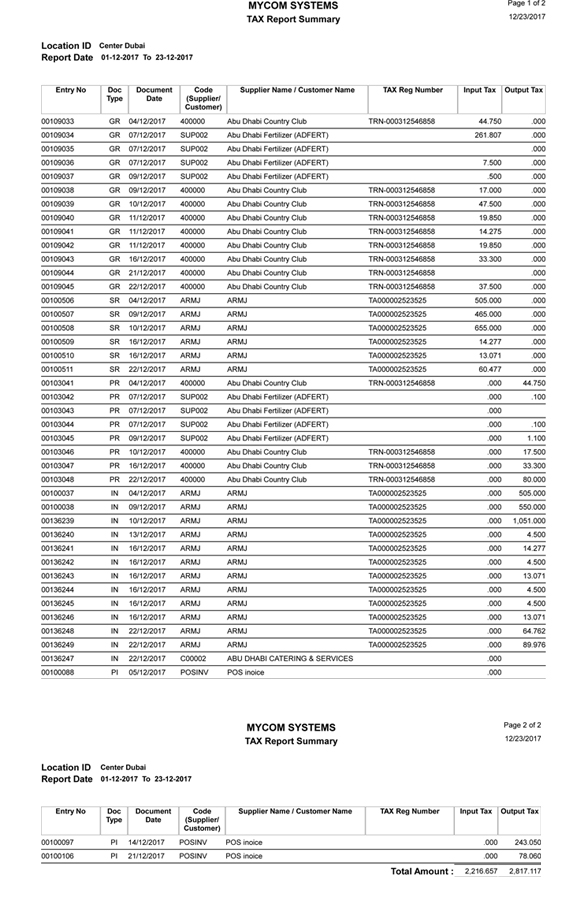

Tax Summary Report